sales tax rate tucson az 85719

This includes the rates on the state county city and special levels. Price and Tax History.

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

31 rows with local taxes the total sales tax rate is between 5600 and.

. Rates include state county and city taxes. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. Has impacted many state nexus laws and sales tax collection.

Groceries and prescription drugs are exempt from the Arizona sales tax. 6 hours agoFor Sale - 1121 E 7th St Unit Lot 72 Tucson AZ 85719 - 1609 sqft home. The local sales tax rate in Tucson Arizona is 87 as of July 2022.

The estimated 2022 sales tax rate for 85719 is. The latest sales tax rates for cities in Arizona AZ state. 2550 N Vine Ave Tucson AZ 85719-3358 is a single-family home listed for-sale at 525000.

Sale and Tax History. State Tax Rates. The minimum combined 2022 sales tax rate for Tucson Arizona is.

Use the physical address or the zip. The Arizona sales tax rate is currently. 3 beds 2 baths 1295 sq.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and. Arizona Tax Rate Look Up Resource. The estimated 2022 sales tax rate for 85719 is.

View more property details sales history. Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. Oro Valley And Tucson Real Estate Mobile App The Best In The Business Try It Http Www Tucsonrealestateandhomes.

Multi-family 2-4 unit located at 1733 E 13th Tucson AZ 85719 sold for 220000 on Jul 3 2014. The average cumulative sales tax rate in Tucson Arizona is 844 with a range that spans from 61 to 111. Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the.

Home is a 7 bed 40 bath property. The 2018 United States Supreme Court decision in South Dakota v. Charming 3 bedroom 2 bathroom.

Price History Tax History. Townhouse located at 3454 N Richland Dr Tucson AZ 85719 sold for 265000 on Nov 17 2022.

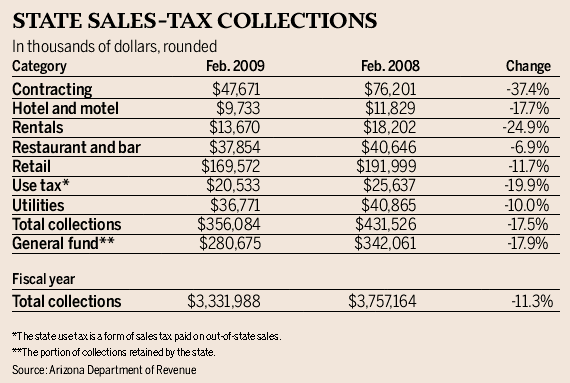

Arizona Sales Tax Collections Fell A Sharp 17 5 In February

Arizona Sales Tax Small Business Guide Truic

1548 E 9th St Tucson Az 85719 Realtor Com

Sales Tax Transaction Privilege Tax Queen Creek Az

State And Local Taxes In Arizona Lexology

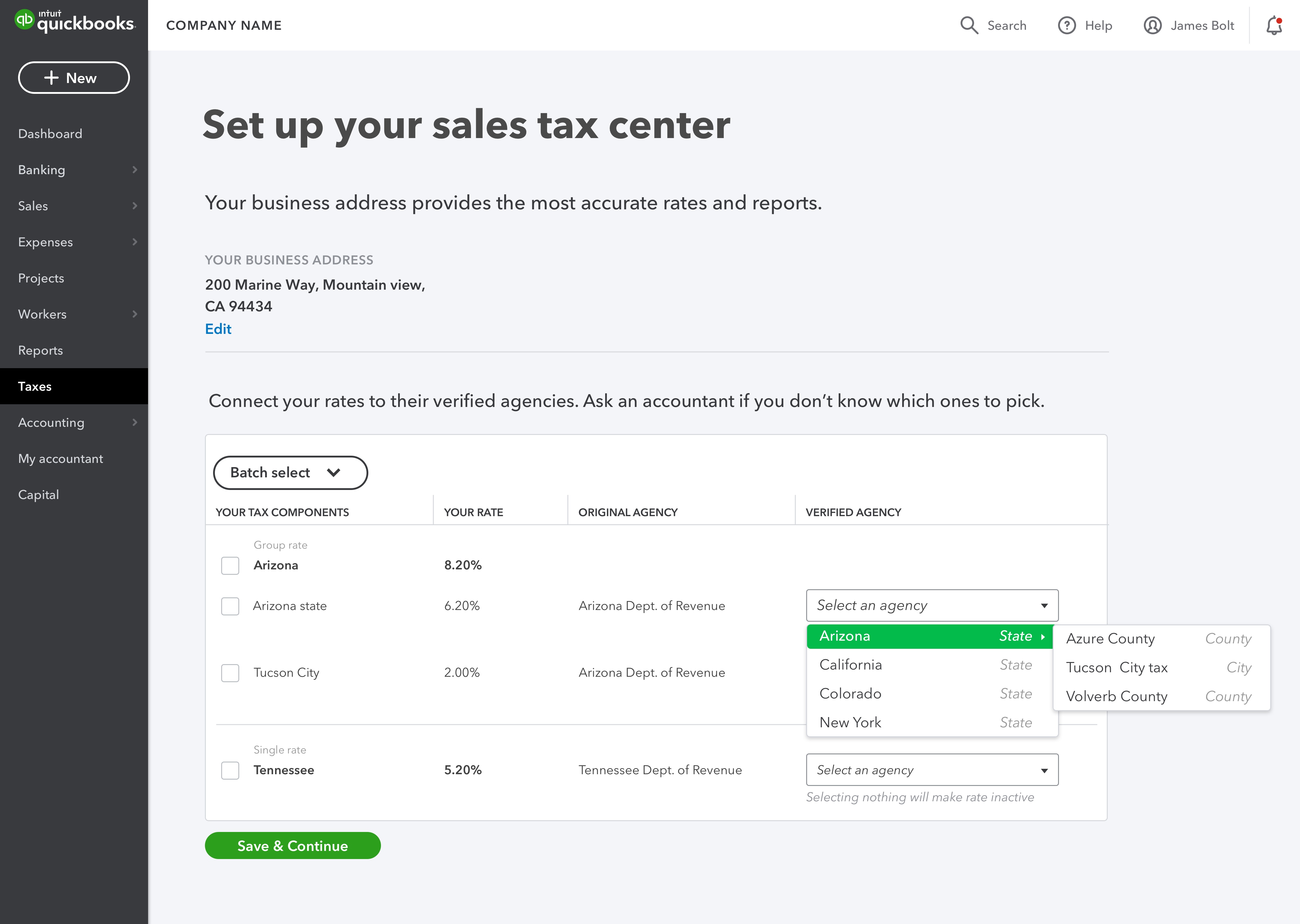

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

Tucson Arizona Retro United States Travel Art Poster Print Ebay

Rate And Code Updates Arizona Department Of Revenue

Arizona Voters Broadly Oppose Sales Tax On Digital Services Nfib

A Detailed Guide To Ecommerce Sales Tax For U S Merchants Bean Ninjas

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

What S New In Quickbooks Online November 2019 Quickbooks

Complete Guide To Arizona State Income Tax Payroll Taxes

Arizona Sales Tax Permit Application Fill Out Sign Online Dochub

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

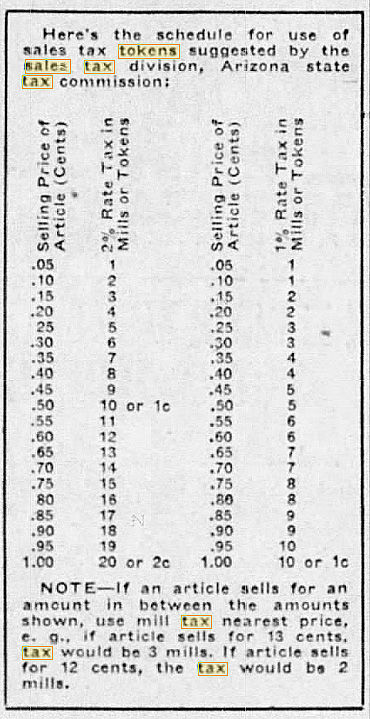

Sales Tax Chart 1937 Tucson Com

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Where Do Arizona Residents Receive Most Value For Property Taxes Prescott Enews

Arizona State Taxes Overall Tax Burden For Az Arizona Commerce Authority